Market update:

You would be hard-pressed to find voices of optimism on the property market front these days. As inflation rages, and proves hard to tame, even with sky high rates, buying activity has effectively been choked off, without any indication of when that will resume in a way anything like what we may call normal. Foreign demand is also likely taking a hit due to the instability in the Middle East in general, though this cannot be considered as a factor of slowness amidst the local market, which, as always, is the main driver in terms of the overall health of the RE market in Turkey. Nonetheless, it adds to the currently gloomy perception that reigns supreme. A few months ago there were strong indications that this was going to be a busy spring and an even busier summer season, but there has been a cooling recently due to regional uncertainty. Regardless, as Turkey is seen as somewhat of a safe haven in the region, this should not lead to any profound reversal of interest in Turkish RE.

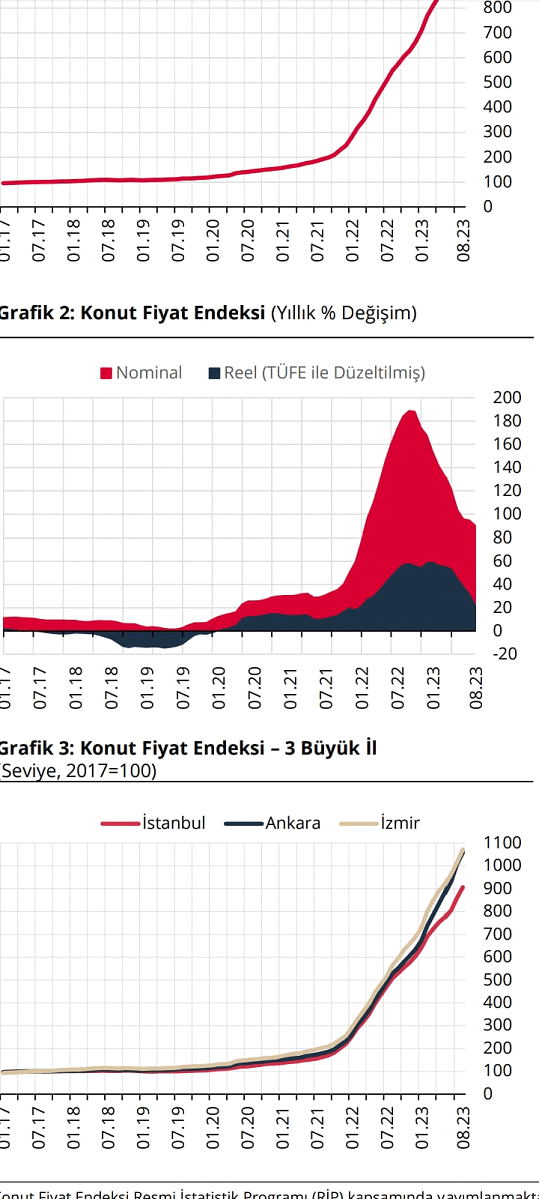

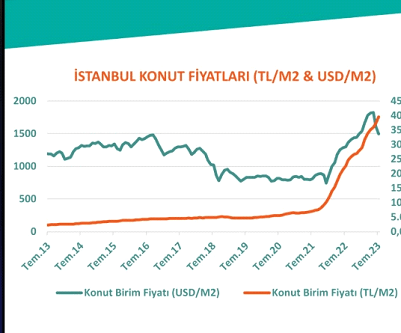

If I were to venture a guess, prices are probably 15-20% off their late 2022 early 2023 highs. Although calling a bottom seems very pre-mature, there is a strong case to be made for this being a good enough entry point for those looking to acquire Turkish property.

Airbnb update:

There are still many unknowns on this front, but one thing is for sure. As of May 1st, you will need a license to be able to advertise on booking.com and Airbnb.com to operate in Turkey. This will certainly hugely reduce the number of available airbnbs. Those who do have the license, and have a quality product, can expect to do very well indeed in terms of both bookings and overall earnings.

In light of this, we are at the final stages of getting 3 licenses for buildings approved. I would expect that by some time in May. Perhaps in the next zoom session, I will go over the basics in terms of costs and procedure. The main hurdle, as always, is that all of the owners in the building must consent. Apart from this, it all seems quite doable. We are reasonably keen to operate a handful of airbnbs that are tending towards the higher end, as we feel they will perform well for clients and will be worth our while as well to manage. As you will need the license number to advertise on the main platforms, running an Airbnb in the legal grey zone is not even an option anymore.

General rental market update:

The rental market is much patchier than it has been in the past several years. Still plenty of demand, but prospective tenants are really digging in on negotiations and are slow to sign on the dotted line. Definitely get a sense that they are really shopping around, exercising maximum caution and researching market thoroughly. Of course, given the pressure on their disposable and non-disposable incomes, this should come as no surprise. It is also a constant exercise for us to re-calibrate what is a fair and real market price at any given point in time. It is also all very unfamiliar territory for us, not having a fixed idea of values in high-inflationary environment. Challenges all around, it could be said. The good news is that this year rental raises can be done according to official inflation data and will not be capped as they were last year.

Dealing with intra-year yield attrition:

Thorny subject. And Im running out of time. Will discuss in zoom subjects and get some feedback from everyone.

Sicily trip:

I recently returned from a Southern European tour of sorts. Checked out RE in most of the towns/cities I visited and was mostly not very impressed, with the exception of Sicily, Italy, which seemed to offer a good combination of lifestyle, low entry point for investment, decent yield opportunities and possibly a bit of appreciation thrown into the mix. Ladislas (Wandering Investor) will be posting our Sicily video some time in June, at which point I will host some zoom meetings on subject.

Making the case for Kocaeli and Izmir…again!!!

I think it is a great time to re-visit Izmir. It has been kind of low on our radar for the past year and I believe this should be corrected. After visiting Southern Europe, I realize what a huge and dynamic place it really is, and how much it has to offer in terms of lifestyle. Sure, Europe is interesting and all, but after visiting city after city, it began to feel distinctly “museum-like”. Some locales just felt left behind, or on the cusp of it. One town or city seemed to blur into another. On the other hand, Izmir definitely does not feel “forgotten” or past its “best before date”. It is vibrant and diverse and an interesting city for real estate. A growing downtown corridor, great suburbs like Balcova, Karsiyaka and Narlidere, to name just a few.

Kocaeli also has appeal for lifestyle though not to the extent that Izmir does. Its proximity to nature and to Lake Sapanca are positives, but really accessibility to Istanbul is a main point of attraction.

But the reason why investing in these markets now, especially for CBI buyers, is eminently sensible is that both are much more in line with the laws of local affordability. In Istanbul, there is a bit of a disconnect when it comes to affordability. As practically no Turks are buying for investment due to borrowing rates, let us entirely remove 1 bedrooms from the equation for the time being. Any Turkish buyers currently in the market are looking for places to live, and that means a minimum of 2 bedrooms. In downtown, a well-appointed, fully renovated or newish 2 bedroom, with a lift, and in a good location probably starts at 8 million lira (approx. 250K USD). This is, for the most part, well above what the majority of Turks can afford. In Izmir and Kocaeli, such properties start from 125-150K USD. Sure, salaries are higher in Istanbul, but that is asking people to squirrel away a lot of money…for a long period of time. Due to prohibitive rates, it is hard to imagine any buyer to leverage more than 100K into a purchase with financing. That is the current reality and investors should be mindful of that.

Another great point about these two markets (and probably several others like Bursa, Mersin, etc) is that they are entirely immune to opportunistic CBI pricing. I know this because in many cases we were negotiating on properties, say for 200K, and we told the agent we needed them for CBI purchases and they quickly retorted that they were not suitable for CBI. Why? Because they were under 400K ( : Such is the lack of awareness.

Properties will be distributed in meeting…

We invite you to join u for:

IstanbulInsights with Keith

On Sundays at 20:00* Istanbul time

*13.00EST/ 19.00CET/

20.00TRT/ 02.00SGT (Monday)

Via Zoom:

https://us02web.zoom.us/j/7931208182?pwd=ZndocVNmbXAyTE5uMnNscC9sK0xSZz09

Password for logging in: 1234

‘Just Click’ the above link and be part of the Istanbul Insights with Keith’s property market updates.

Every Sunday we will share more info about the best property deals of the week, market developments, followed by Q+A time.